Applications of LLMs in Healthcare Payers and Providers industry

Categories:

Introduction

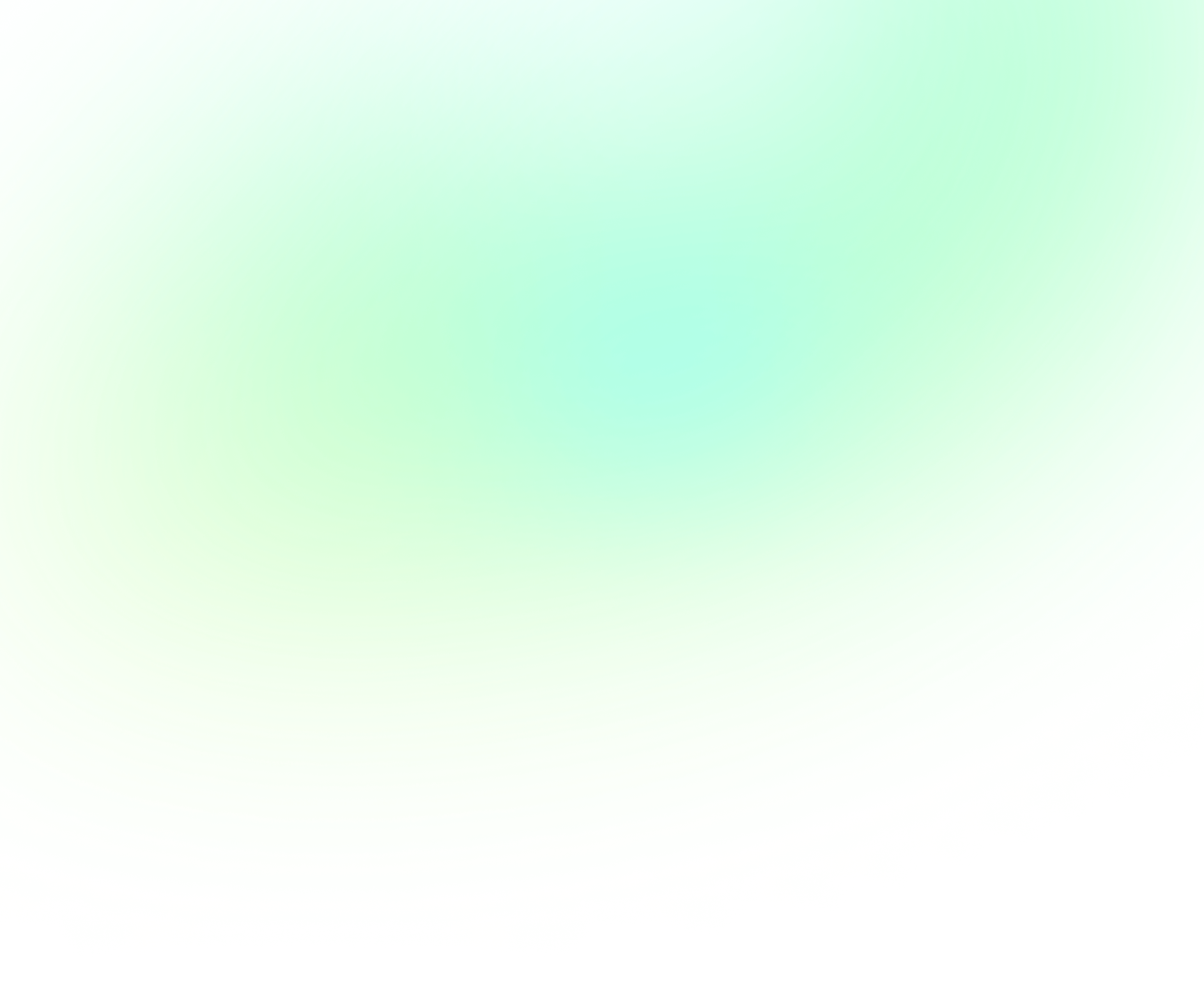

In the dynamic landscape of healthcare, the integration of cutting-edge technologies is revolutionizing every facet of the industry. One such groundbreaking innovation is the application of Large Language Models (LLMs), which harness the power of natural language processing to reshape healthcare, medical and patient care, pharmaceutical practices, healthcare education, research endeavors, and the intricate relationships between payers and providers.

This article delves into the myriad ways LLMs are making waves in the last mentioned industry: that of Payers and Providers withinthe Healthcare sector, mainly for a better understanding of healthcare insurance plans, related costs, risks scores and legal clarity of the coverage of the services.

Enhancing Payers and Providers activity through Large Language Models

LLMs have also emerged as invaluable tools for Healthcare Payers and Providers, offering a multitude of advantages in understanding and optimizing various aspects of the insurance ecosystem.

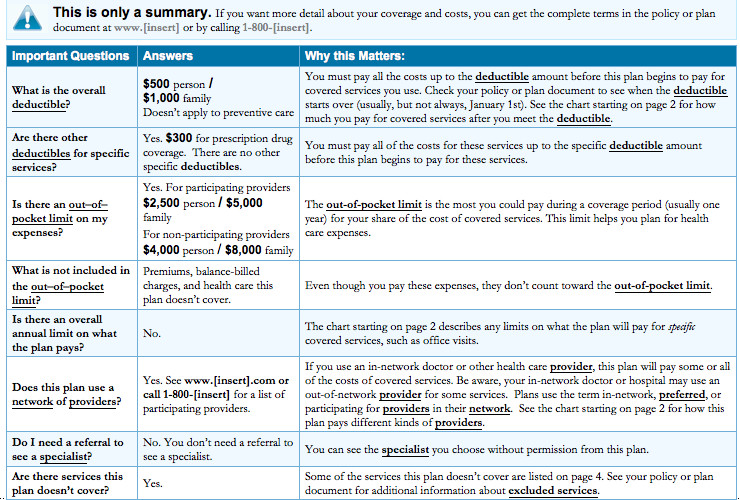

Comprehensive Coverage Understanding

LLMs enable healthcare payers to delve deep into insurance policies, extracting valuable insights into coverage details. This includes understanding what users pay, co-pay structures, benefit packages, participant information, and policy terms. This level of comprehension ensures that payers can offer more transparent and user-friendly explanations to policyholders.

In the case of providers, LLMs empower them to gain a nuanced understanding of coverage parameters. This includes comprehending what is covered under a patient’s insurance plan and what needs to be billed to the user. This streamlined understanding reduces billing errors and ensures providers optimize the reimbursement process.

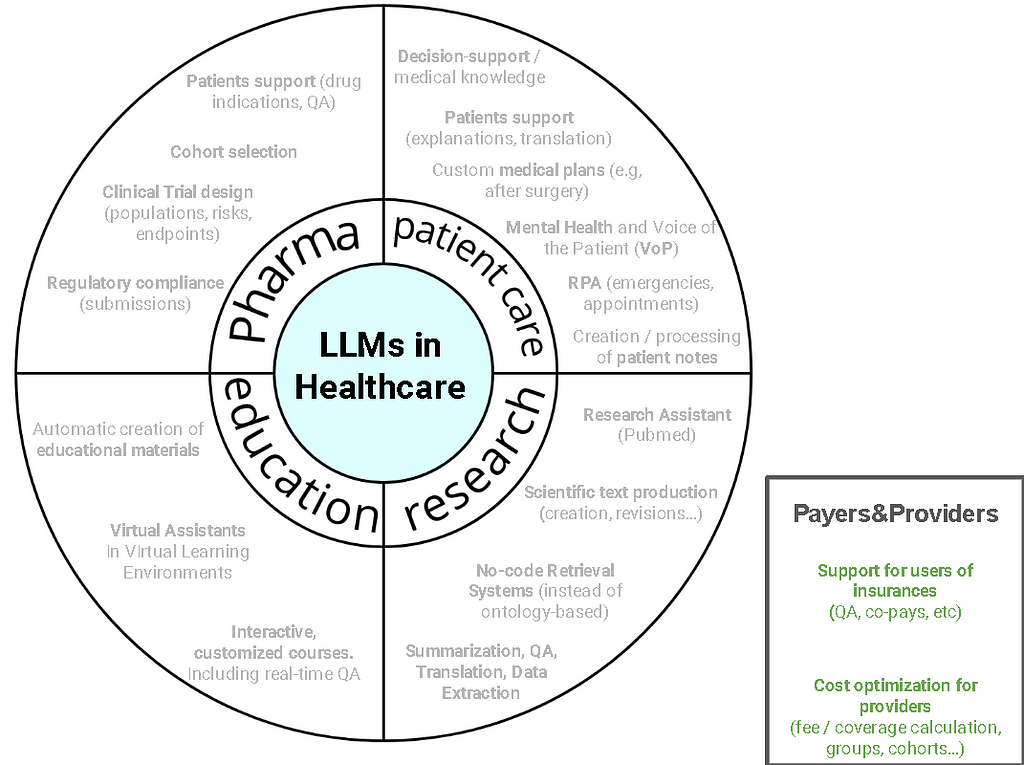

Figure 1: Streebo offers insurance chat-bots which can help users to better understand the benefits or coverage of insurances.

Language models facilitate streamlined table processing, enabling users to efficiently navigate and interpret complex data structures within insurance documents. This leads to enhanced data accuracy and the ability to respond swiftly to user queries regarding their coverage.

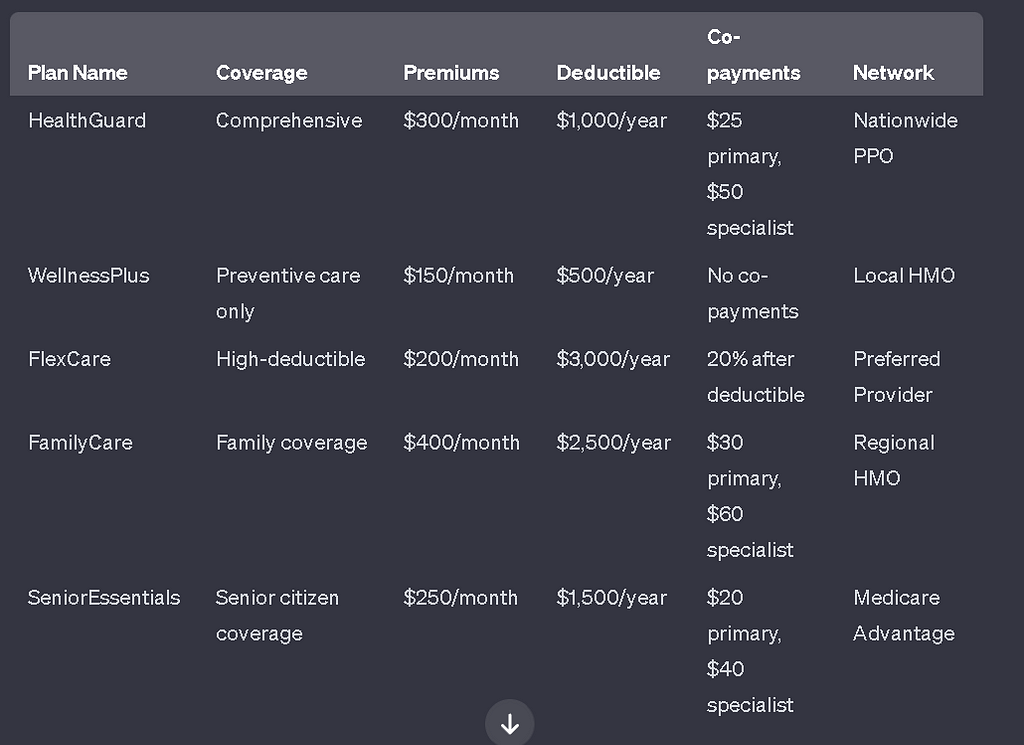

Healthcare Insurance plans have both unstructured and structured information, and sometimes long document question-answering on documents that may contain tables as above may be challenging:

Figure 2: An annex of insurance costs which can be hard to process without the capabilities of LLMs with table understanding

Fortunately, the latest capabilities of LLMs prove beneficial for both payers and providers dealing with extensive insurance documents, both structured and unstructured.

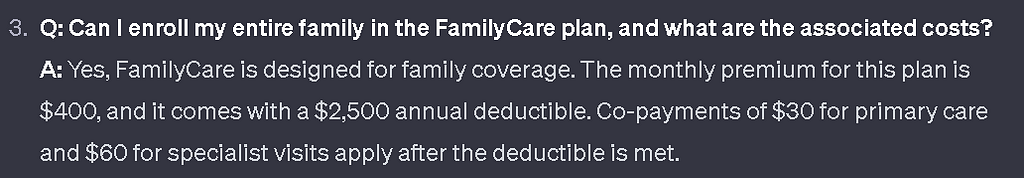

Figure 3: Question-Answering capabilities of ChatGPT over tables

Legal definitions and intricaciescan be extracted effortlessly, allowing providers to make informed decisions while interacting with legal or insurance-related paperwork. By using RAG (Retrieval Augmented Generation), LLMs can leverage your own legal documents, understand them and provide quality answers to both internal and external users of your platform. There have also been successful applications of LLMs for question-answering on legal clauses, not only in the healthcare industry. The image below shows the standard definition of a RAG approach on custom legal or insurance documents, used by LLMs to generate the responses.

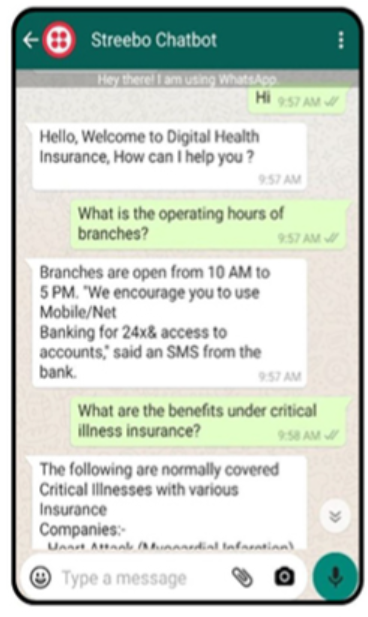

Risk Adjustment and Risk Score Calculation

In the complex landscape of healthcare, the accurate assessment and calculation of medical risk scores and risk adjustments play a pivotal role for both Payers and Providers, including entities like Medicare. These two interrelated concepts are essential tools that enable fair and equitable compensation for healthcare services, fostering a system that aligns financial incentives with the delivery of high-quality care.

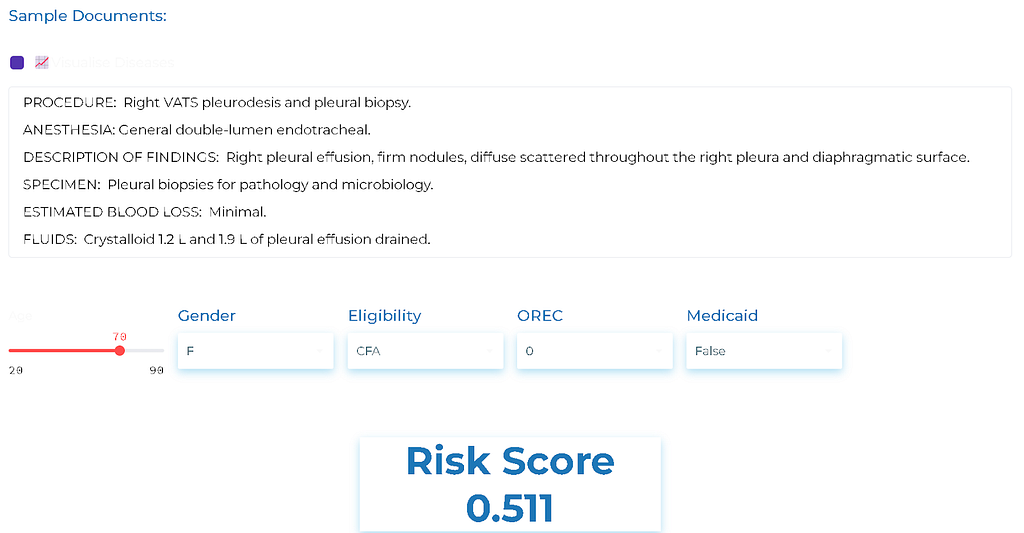

The concept of risk scoresprovides a quantitative measure of the predicted cost of treating a specific patient or group of patients compared to the average Medicare patient. By considering certain patient characteristics and health conditions, risk scores offer a nuanced evaluation of the potential healthcare expenses associated with a particular individual or cohort. This predictive capability not only aids in fair compensation but also facilitates proactive resource allocation, allowing healthcare providers to tailor their strategies and interventions to effectively manage and improve the health outcomes of higher-risk patients. In the broader context, these risk assessment tools contribute to the overarching goal of optimizing healthcare delivery by fostering a system that prioritizes efficiency, quality, and patient-centric care.

Figure 4: John Snow Labs HCC Risk Score Calculation using NLP to automatically assess the potential costs of treatment of different patients given a clinical note

Complementing risk scores, risk adjustment serves as a mechanism to recalibrate payments to health providers based on the health status and expected healthcare utilization of their patient population. By accounting for variations in patient health, this approach ensures that providers are appropriately compensated for the care they deliver, irrespective of the underlying health status of their patients. This is particularly critical in avoiding potential biases that may arise if reimbursement were solely based on the volume of services rendered. However, most of the information to calculate the risk adjustment comes from unstructured data (Patient Notes). So having a way to properly process the information to obtain accurate scores is crucial. Fortunately, we can achieve that with the latest LLMs as GPT-3.5 or GPT-4.

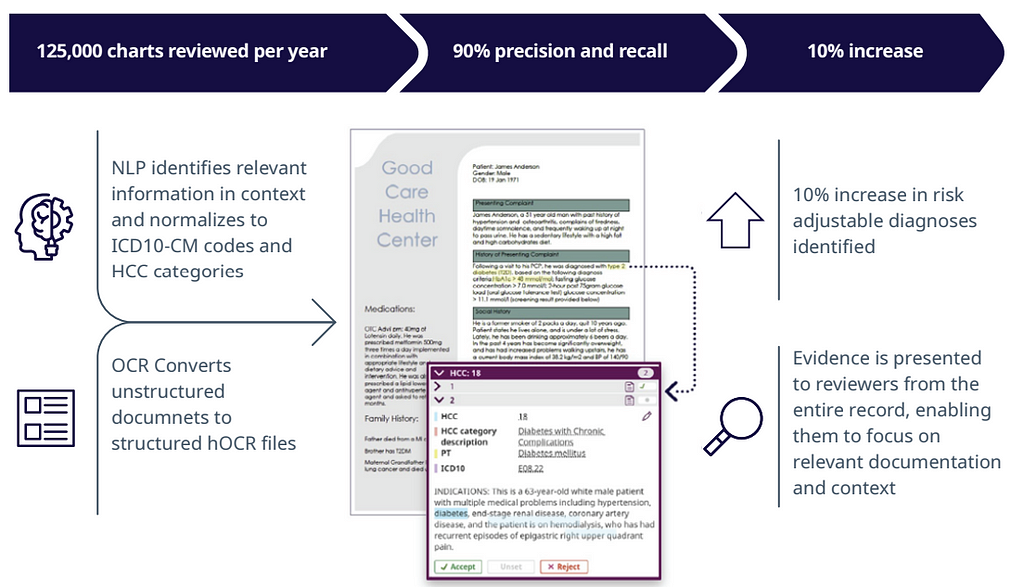

There are numerous success cases reported after using NLP to automate the Risk Adjustment process. For example, in this whitepaper, IQVIA NLP’s claims to have not only automated the process, but increased in 10% the accuracy of their risk assessment compared to human evaluation.

Figure 5: IQVIA NLP solution for Payers and Providers claims a quicker and more accurate Risk Adjustment calculation

Conclusion

In conclusion, the significant impact of Large Language Models (LLMs) on the Payers and Providers in the Healthcare sector is undeniable. This article has highlighted the multifaceted contributions of LLMs, emphasizing their role in enhancing comprehension of healthcare insurance plans, deciphering related costs, evaluating risk scores, and providing legal clarity on service coverage. As these language models continue to evolve and integrate into the healthcare landscape, their influence is poised to streamline processes, improve decision-making, and ultimately contribute to a more efficient and transparent healthcare system. The transformative potential of LLMs in the realm of Payers and Providers underscores the ongoing technological advancements that hold promise for a more informed and accessible healthcare experience.

Need help?

If you want us to guide you through the implementation of LLMs-based engines for the Payers and Providers (Insurance) industry, our experienced team of NLP engineers with background in healthcare will be happy to help. Just reach out to us at hi@mantisnlp.com

Applications of LLMs in Healthcare Payers and Providers industry was originally published in MantisNLP on Medium, where people are continuing the conversation by highlighting and responding to this story.